Making Money Feels Good,

Keeping it is your key to success.

Things to Consider When Choosing an Accounting Firm

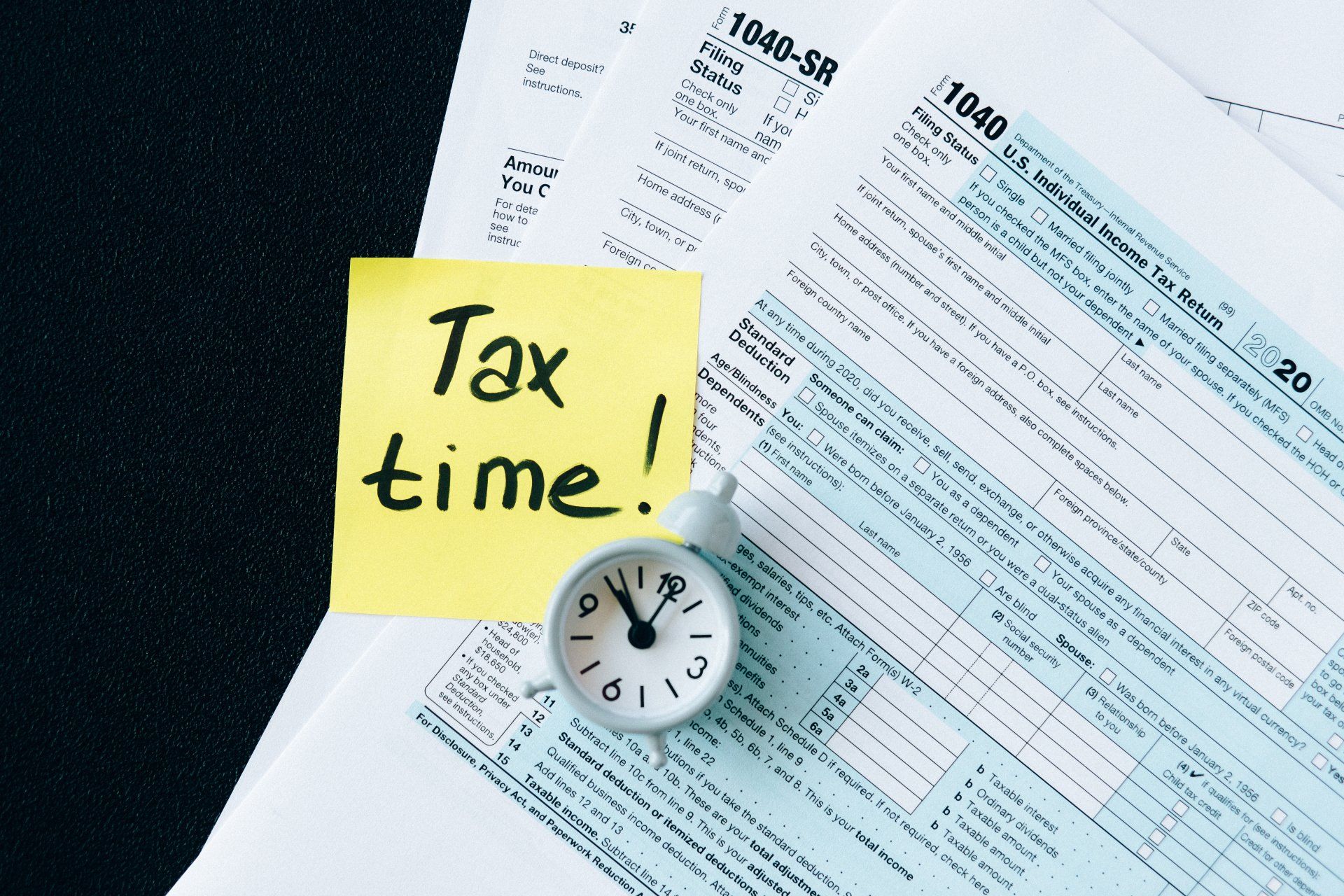

Understanding tax laws can be complicated and frequent updates make it even more challenging to grasp the changing rules. The regulations of tax laws can leave people scratching their heads. That’s why, when filing federal income taxes, managing estate taxes, or selling investment property, you need the assistance of a tax expert. Accounting professionals stay up-to-date on new tax rules, and many provide financial advice and assistance to individuals and small businesses in developing budgets and setting financial goals.

Why do Businesses Need Professional Accountants?

Managing taxes is important for businesses to ensure tax compliance and achieve their financial goals. However, startups and small businesses often take charge of everything, including finances, to minimize their expenses. While it is possible to manage other tasks, accounting duties need specialized knowledge. Unless you are a financial expert, hiring a seasoned accountant is the best option to handle your books and taxes. From small enterprises to large companies, every business needs to hire a reliable accounting firm. However, with plenty of accounting firms available, it can be challenging to pick the best one.

So, to help you narrow down your selections, we've listed some tips to help you find the best accounting professionals.

1. Services Offered

When looking for an accounting firm, you need to first consider what type of services you need. Some services offered by accounting firms include tax preparation, bookkeeping, and financial reporting. Before you start looking for a firm, make sure you know your business needs. For instance, if you need assistance with cross-border transactions, then the firm should provide cross-border tax planning services. Likewise, when looking to minimize estate taxes, you need a professional adept at managing inheritance taxes.

2. Certifications

Accountants are regulated in many countries by professional organizations that oversee accounting qualifications and strive to maintain high professional standards. Professional accountants may be referred to as Certified Public Accountants or Chartered Accountants, depending on the jurisdiction. CAs are highly qualified professionals who have completed degree-level studies as well as have job experience. It’s best to hire a certified accountant who will be able to contribute value to your organization. If you need some basic bookkeeping service, you may consider a non-certified professional. But when looking for comprehensive tax planning and other financial services, go for a certified public accountant (CPA).

3. Relevant Experience

An accounting firm may list multiple services on its website. However, you need to double-check their expertise. It’s important to ensure that the accountant has enough experience in the service you need. You need a professional who has at least 5 years of experience in preparing taxes for a business similar to yours. To evaluate their experience, you may check the list of their past clients and even read their reviews and testimonials. It's best if they have worked with organizations in similar sectors to yours, as this will help them grasp your company's specific requirements.

4. Discuss Fees

Ideally, you should fix a meeting to talk face-to-face with the accountant. During the initial consultation, you can discuss your accounting needs and future expectations. The meeting will allow you to ask questions, clear your doubts, and get an idea about their professionalism. It’s important to discuss the fee before hiring an accounting firm. There is no universal, set standard by which accountants charge. Some will charge by the hour, while others may charge a monthly fee or a portion of your turnover. You may use your negotiation skills to get the best prices. When finalizing things, make sure to get written quotes from all of the accountants you interview, then thoroughly compare them